Invoice lifecycle management

Service overview

Join us on a journey towards increased automation, efficiency, and optimal financial flow. Dive into our streamlined invoice lifecycle service, seamlessly unifying invoicing and credit management.

Automated invoice lifecycle management

You create an invoice, and the rest is handled by Ropo.

Ropo One™ invoice lifecycle management is designed to streamline your entire business flow by combining invoicing, payment monitoring, sales ledger, and receivables management into one platform. Our holistic and highly automated invoicing process, including outsourced sales ledger management, improves cash flow optimization, maximizes cost savings, and enables full visibility.

You continue to create invoices using your current system – we integrate Ropo One™ into it and provide you with a seamless invoicing workflow.

Multichannel invoice and document delivery

Enhance customer engagement and brand recognition with customized invoices.

Ropo’s highly automated and efficient invoice delivery service turns your invoices into a powerful communication channel with advanced visualization, branding, and segmentation features. It is designed to meet end-customer expectations with a wide selection of delivery methods. When invoice data is received in Ropo One™, invoices are automatically delivered according to customer preferences, whether digitally via online and mobile channels or as printed paper invoices prepared for postal delivery. The entire workflow is monitored in Ropo OneView in real-time.

The service adapts to businesses of all sizes, regardless of invoicing volume or sending frequency. It ensures cost-effective sending of electronic and paper invoices, as well as invoice-related documents, using the most trusted and commonly used delivery methods.

Key benefits:

- Highly automated, efficient process:

Seamless digital data transfer ensures process efficiency and timely invoice delivery. - Advanced customization and invoice branding:

Brand your invoices per product line and tailor communications by customer segment or delivery method. - Trusted delivery methods:

Deliver invoices the way your customers prefer, while promoting the transition to digital invoices. - Reduced invoicing costs:

A cost-effective solution offering potential savings in direct invoicing, platform, and resource costs. - Improved control:

High-quality reports on invoice delivery metrics in real-time.

Sales ledger service and payment control

In-house, integrated, or outsourced to Ropo.

Ropo’s end-to-end invoice lifecycle management includes payment monitoring tailored to fit our client’s needs – we can support your team with payment monitoring or handle the entire sales ledger management for you. Our service tracks the status of invoices, triggers the reminder process, ensures your sales ledger is always up-to-date, and provides reporting for a holistic view of receivables.

The ledger service is activated when invoicing materials are received in Ropo One™. Each receivable forms a single task, which is automatically monitored throughout the workflow until payment is received. The ledger service is designed to minimize routine work related to payment monitoring, freeing up resources for your core business. Incoming payments are automatically processed, and our ledger team manages refunds related to overpayments and investigations on any payments that lack clear allocation details.

Key benefits:

Automated reminders

Remind your customers when payment delays occur.

Ropo’s reminder service is an efficient and effortless way to improve receivables management. When the due conditions are met, reminders are automatically delivered using the same method as the original invoice, if reminder delivery is supported. Reminder triggers can be tailored for each customer segment, and the process can include low-threshold notifications such as SMS reminders.

A friendly reminder is an effective way to influence customer payment behavior and reduce overdue payments. The automated flow reduces manual work and helps you accelerate cash flow, while Ropo ensures compliance with all legal requirements.

Key benefits:

Tailored debt collection services

Reduce credit risk with professional collection.

With Ropo’s collection services, the amount of credit losses can be effectively reduced. Receivables can be collected with more certainty when actions are launched systematically without delays. If a receivable remains outstanding after reminders, it can be advanced to collection either automatically when due conditions are fulfilled or according to the protocol agreed upon with the client.

Debt collection procedures can be tailored according to customer segments, ensuring efficient credit risk management while supporting good business relationships. The collection process proceeds automatically in compliance with the latest legislation and good collection practices.

Key benefits:

- Customized collection processes: Segmented debt collection strategies with defined thresholds and procedures enable effective collection actions tailored for each customer group.

- Defined automation: Increase efficiency and ensure timely action by defining which collection flows proceed to collection automatically and which require manual approval.

- Industry-specific collection practices: Define your debt collection process with industry- and country-specific activities such as disconnection of service for overdue invoices, winter- and summertime adaptation, deposit handling, or B2B draft collection with the threat of public disclosure.

- Comprehensive debt collection services: Our collection service covers everything from voluntary collection to legal collection and debt surveillance. The collection process can be supported by outbound activities, such as phone calls and SMS messages.

- Built-in compliance: Ropo One™ enforces legal criteria, ensuring that all debt collection flows remain within compliance conditions.

Extensive customer care

Seamless payment support throughout the invoice lifecycle.

Ropo’s end-to-end invoice lifecycle service includes high-quality customer service related to payments. We assist your customers with due date transfers, payment arrangements, and other payment-related questions. Depending on the service package, our end customer service includes personal assistance from the invoice phase to reminders and debt collection.

We serve your customers both in person and online via MyRopo. In MyRopo, your customers can access their invoices, check invoice status, and handle payments 24/7. Advanced self-service features and online customer support ensure that interaction is quick and easy, enhancing the overall customer experience.

Key benefits:

- Advanced self-service features: MyRopo ensures that handling payments and making payment arrangements is quick and easy.

- Multichannel customer service: We serve your customers in person and online via MyRopo. Your customers can contact us via MyRopo message center, chat, or phone.

- 24/7 online assistance: Our customer service is available from morning until evening. MyRopo offers 24/7 access with self-service features and chatbot assistance for your customers at any time.

- Multilingual service: We ensure that contacting us is easy. We serve your customers in English, Finnish, Swedish, and Norwegian.

- Professional single contact point: We are known for our professional and friendly customer service. We address your customer’s needs comprehensively, assisting with both outstanding payments and those not yet due.

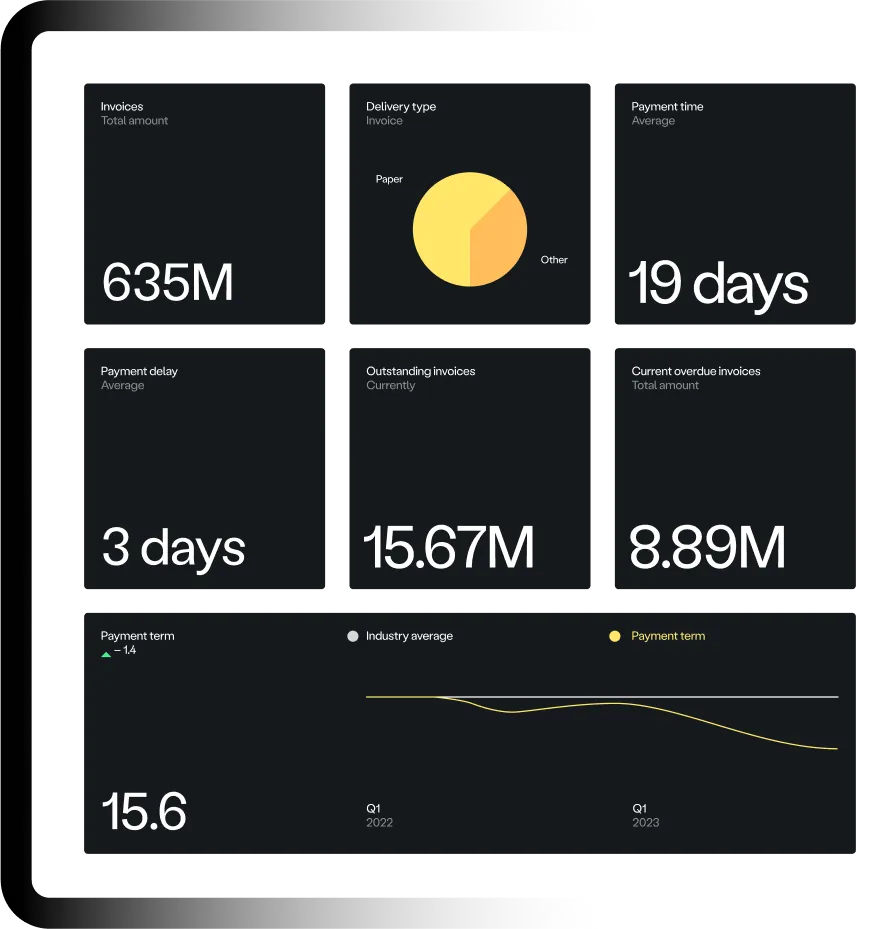

Real-time reporting and business intelligence

Increase financial control with real-time data and advanced analytics.

Ropo’s invoice lifecycle service gives you full control throughout the invoice and payment flows. The invoice journey is traceable and reported in real-time, providing a comprehensive, 360-degree financial overview and the ability to drill down into granular details. This enables in-depth analysis, accurate cash flow forecasting, and data-driven decision-making.

The key enabler is Ropo OneView, our advanced business intelligence tool that analyzes invoice and payment flows, turning them into clear KPIs and visual dashboards. You can monitor invoicing practices and operational efficiency, as well as key service parameters related to Ropo’s performance, customer service quality, and volumes. Designed for CFO offices and company management, Ropo OneView enhances cash flow monitoring, credit risk management, and financial reporting.

Key benefits:

Get in touch

Interested in reorganizing your invoice lifecycle management for improved efficiency and transparency?

Service and client Insights

Customer service system disruption affecting email communication and MyRopo Message Center

Read more

News

MyRopo Message Center: transition to secure online messaging

Read more

News

Oomi Strengthens Financial Control with Real-Time Insights and Intelligent Analytics

Read more

News

Log in

Log in Log in

Log in